Network Assets - When is Enough Enough?

VHC911- Stat v.13

UVM Health Network Acquires Nearly $2Billion in Liquid Assets

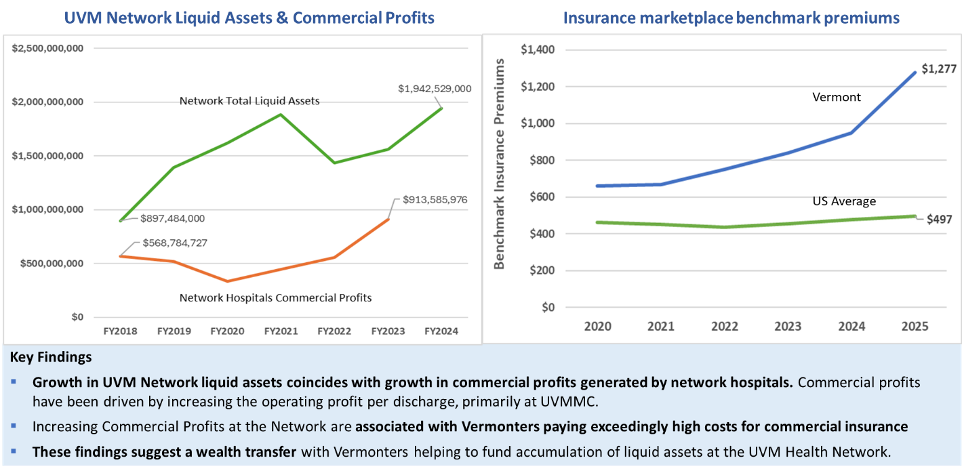

In recent newsletters, VHC911 has detailed how commercial profits at the UVM Health Network (UVMHN or The Network) offset losses from Medicare patients, Medicaid patients, bad debt and so on. But even after we accounted for these offsets and subsidies the Vermont side of the Network gives the New York hospitals, there has always been a lot of money left over.

Prompting two important questions:

(1) Where did the profits go? (See below.)

(2) Do the Network’s commercial profits need to be so high? (Spoiler alert: No).

The Network’s leadership has justified high commercial profits by citing the high costs of health care for our state’s aging population with complex needs. Plus, there is a stated loss of revenue from Medicare, Medicaid, and uninsured patients.

The VHC911 Coalition has examined these factors and shown that they only explain a portion of commercial profit generated by Network hospitals – $2.247 Billion from 2020 to 2023, including $913,585,976 in 2023 alone. Even factoring in the $65,955,012 loss that the Network’s NY hospitals reported from 2020 to 2023, the level of commercial profit generated by Network hospitals cannot be justified in the terms they have used to date.

Our research also prompted a response from UVMHN, complaining about our data in a public email sent May 13, 2025. In that message the Network discounts our research as an “estimate” and then suggests the right place to look for factual data are the audited reports filed by hospitals with the Center for Medicare and Medicaid and signed by hospitals CEOs. We agree.

What VHC911 found when we examined the Network’s audited financial reports

Audited financial reports submitted by UVMHN reveal a transfer of wealth from commercially insured Vermonters to the Network.

According to audited financial reports submitted by both UVMMC and the Network, and signed by their respective CEOs, significant profits from the UVM Medical Center were transferred to the Network in the form of board-restricted liquid assets. These are assets that are restricted for a specific use by the Network's Board of Directors, such as a future project or to cover potential liabilities. The funds can be released or devoted to a different purpose solely at the discretion of the board.

Between 2018 and 2024, liquid assets for the Network and UVMMC combined went from $897 million to $1.9 billion. That’s an increase of $1,045,045,000 (116%), averaging about 19% year-to-year growth.

This accumulation of cash assets occurred at the same time as the Network hospitals collectively enjoyed rapid growth in commercial profits. Vermonters, meanwhile, experienced year-after-year, double-digit increases in commercial insurance premiums that amounted to a 92% hike since 2018 (Figure 1).

Figure 1. Accumulation of liquid assets at the Network and commercial insurance prices in Vermont.

The audited financial reports submitted by UVMHN reveal that money went from the pockets of Vermonters, Vermont business, tax payers, and the reserves of Blue Cross of Vermont (our largest commercial insurer) to fund the rapid accumulation of liquid assets at the Network.

The Network Board of Directors may consider this prudent financial management, since the Network needs liquid assets to respond to immediate expenses or financial emergencies. However, at what point does the Network Board of Directors decide that enough liquid assets have been accumulated? And will they acknowledge the negative impacts on rising commercial insurance premiums, or the impact on the financial viability of Blue Cross of Vermont?

Here's a deeper look

The finances of the Medical Center and the Network are intertwined, and it is the revenue generated at Network hospitals, UVMMC in particular, which largely funds the Network. To really understand the liquid financial assets of the Network, it is essential to examine both the financial assets of the UVMMC and UVMHN (Figure 2).

Figure 2. Liquid financial assets at UVM Medical Center and the UVM Health Network

UVMMC’s assets on hand have held steady between $600-800M between 2018 and 2024. Financial audits show that the Network’s liquid assets, on the other hand, blossomed from $20.6 million in FY2018 to $1.1 billion in FY2024, an increase of $1,093,568,000, or an 884% year-to-year growth.

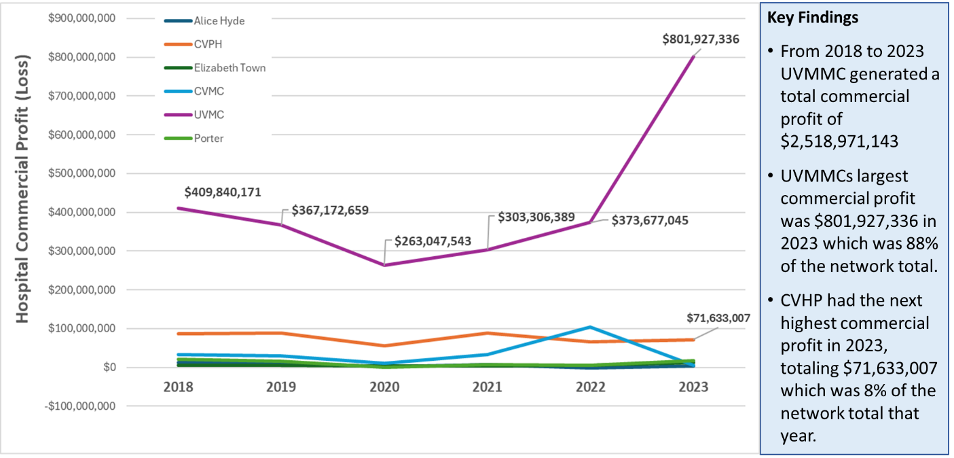

Commercial profits from hospitals are a major source of Network funding. Notably, UVMMC was able to generate a cumulative commercial profit of $2.5 billion from 2018 to 2023, an amount sufficient to fund the growth of the Network’s financial assets even while UVMMC largely maintained its own liquid cash reserves of over $800 million (Figure 3).

Figure 3. Commercial profit (loss) for Network hospitals.

A Call to Action for Network Leadership

Combined with previous findings, the accumulation of liquid financial assets paints a more complete picture of how Network operations have led to Vermonters having such high costs for commercial health insurance.

Simply put, the UVM Network is now an extremely expensive healthcare conglomerate with a top-heavy business culture that emphasizes accumulation of financial assets and redundant layers of management & administration. This has been a multi-year progression contributing to the cost & affordability crisis that is impacting Vermonters today (Figure 4).

Figure 4. Impact of Network business culture on affordability & access in Vermont.

The Network leadership and Board of Directors must change direction, and quickly.

The Network tells us they agree with the need to operate more cost effectively, reduce layers of administration & management and deliver better value to Vermonters. It’s not clear they appreciate the scale or urgency required for this shift. Nor does Network leadership acknowledge the necessary change in culture required to truly empower clinical teams to make reforms that will improve quality and outcomes. Vermont will not see a needed transformation without a deliberate, data-driven culture where staff and management share ideas and common goals.

Network leadership and the Network Board must acknowledge and take responsibility for the negative financial impact they have had on all aspects of affordability in Vermont, including their role in driving up commercial insurance costs and pushing Blue Cross of Vermont to the brink of insolvency.

They must also work with the Green Mountain Care Board to achieve budgets that actually reduce the cost of commercial insurance for Vermonters. They must recognize, as well, that they have accumulated sufficient financial assets to lower the rates they charge to commercial insurers. And they must vow to protect patient care, which is too often the scapegoat for poorly managed hospitals.

The VHC911 Coalition will continue to examine the data using public, credible sources that help us all understand how we’ve gotten to the crisis we are in.

Data from this analysis comes directly from UVM Health Network's website.